Transaction monitoring

Setting custom anomaly detection thresholds

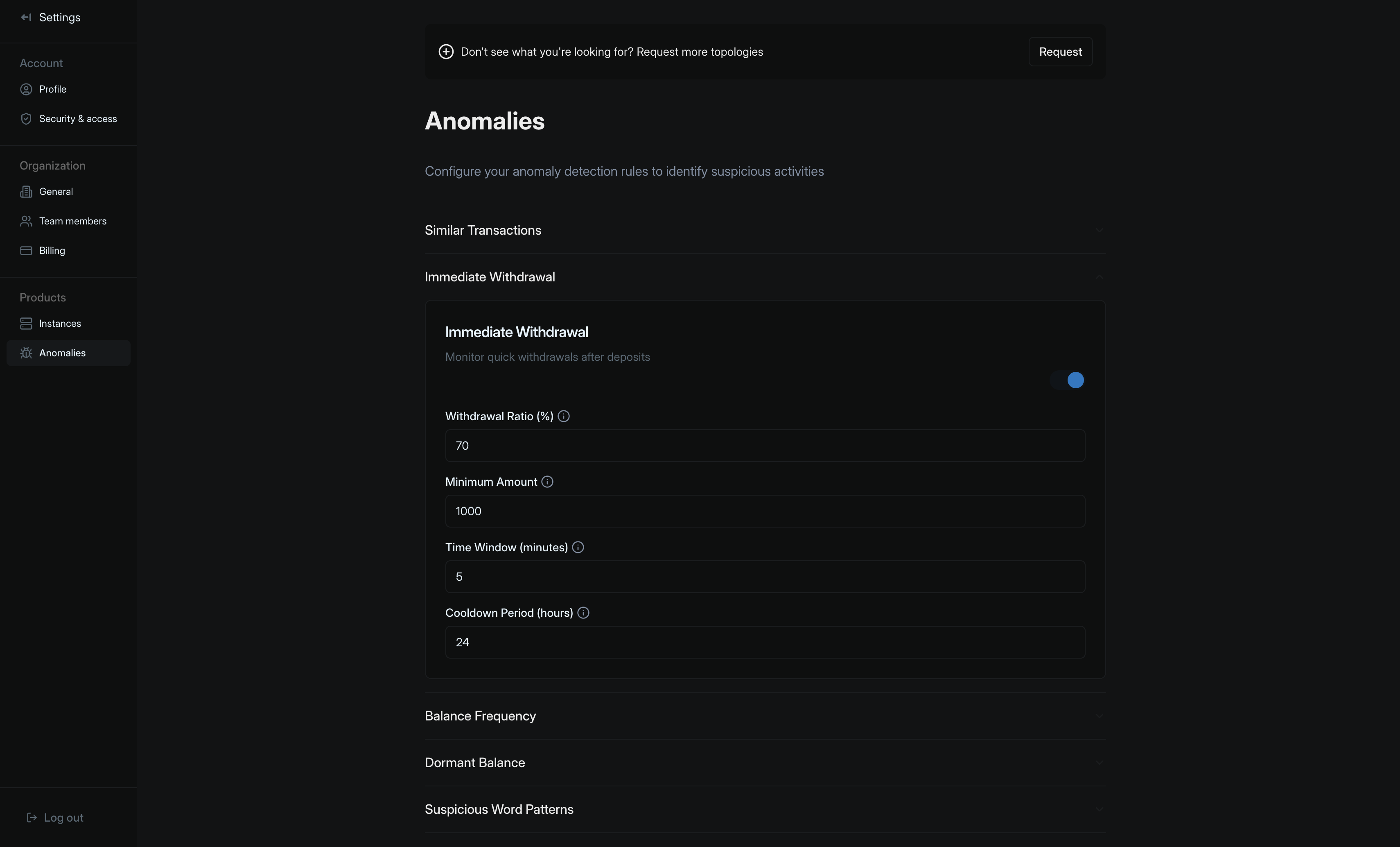

Configure your anomaly detection rules (for AML & compliance) to identify suspicious activities

Only available on the Pro plan.

Overview

Protecting your financial operations from fraudulent activities requires a careful balance of security measures and operational efficiency. This guide will walk you through the essential settings for configuring fraud detection parameters, helping you establish effective barriers against unauthorized or suspicious transactions while minimizing false positives that could impact legitimate business operations. Whether you’re new to fraud prevention or looking to optimize your existing security measures, understanding these thresholds is crucial for maintaining a robust defense against financial fraud.Setting thresholds

Blnk automatically sets a minimum configuration once anomalies are activated for your Cloud workspace.Similar transactions

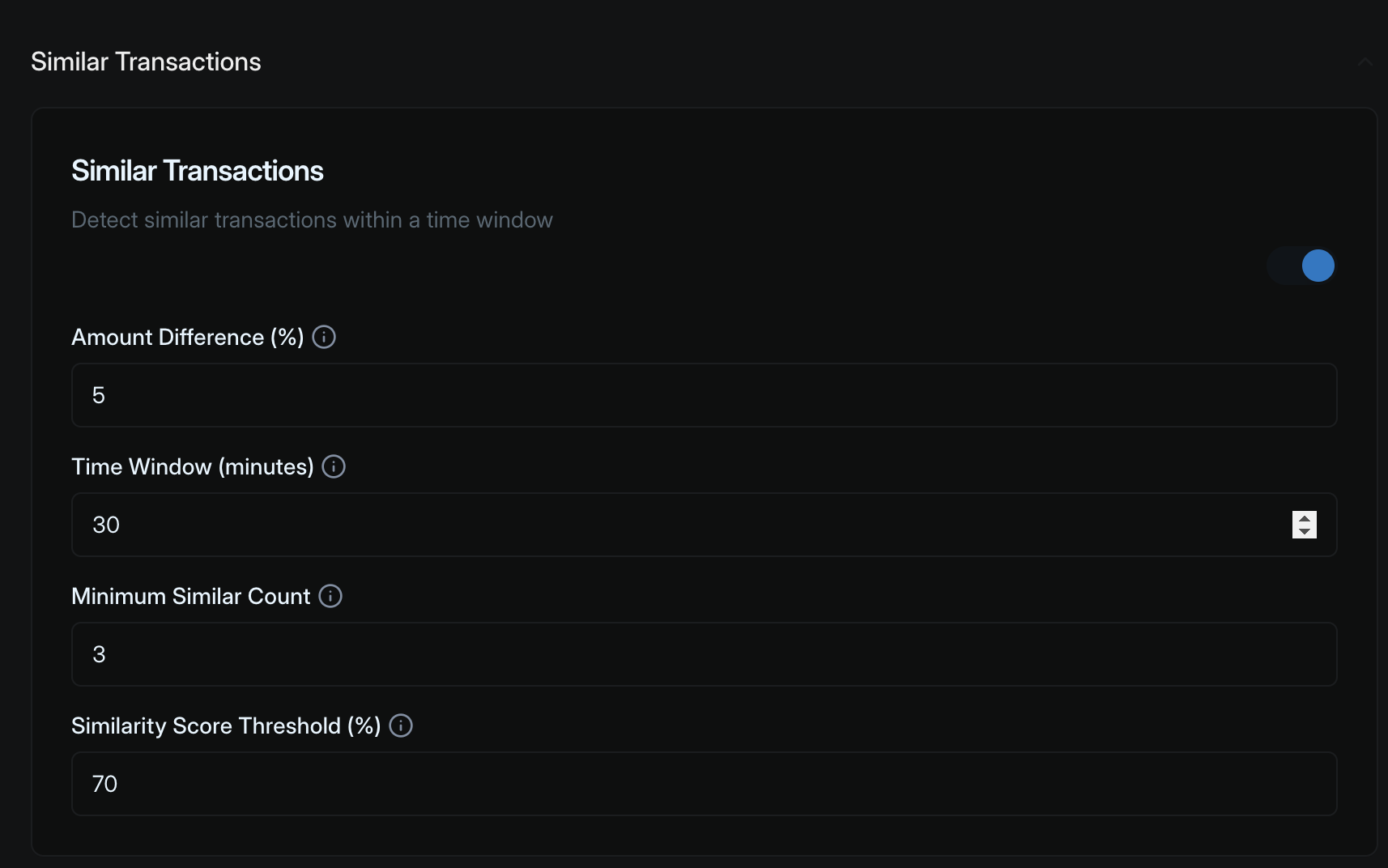

Amount difference (%)

Amount difference (%)

Default is set to 5%

Time window (in minutes)

Time window (in minutes)

Default is set to 30 minutes

Minimum similar count

Minimum similar count

Default is set to 3

Similarity score threshold (%)

Similarity score threshold (%)

Default is set to 70%

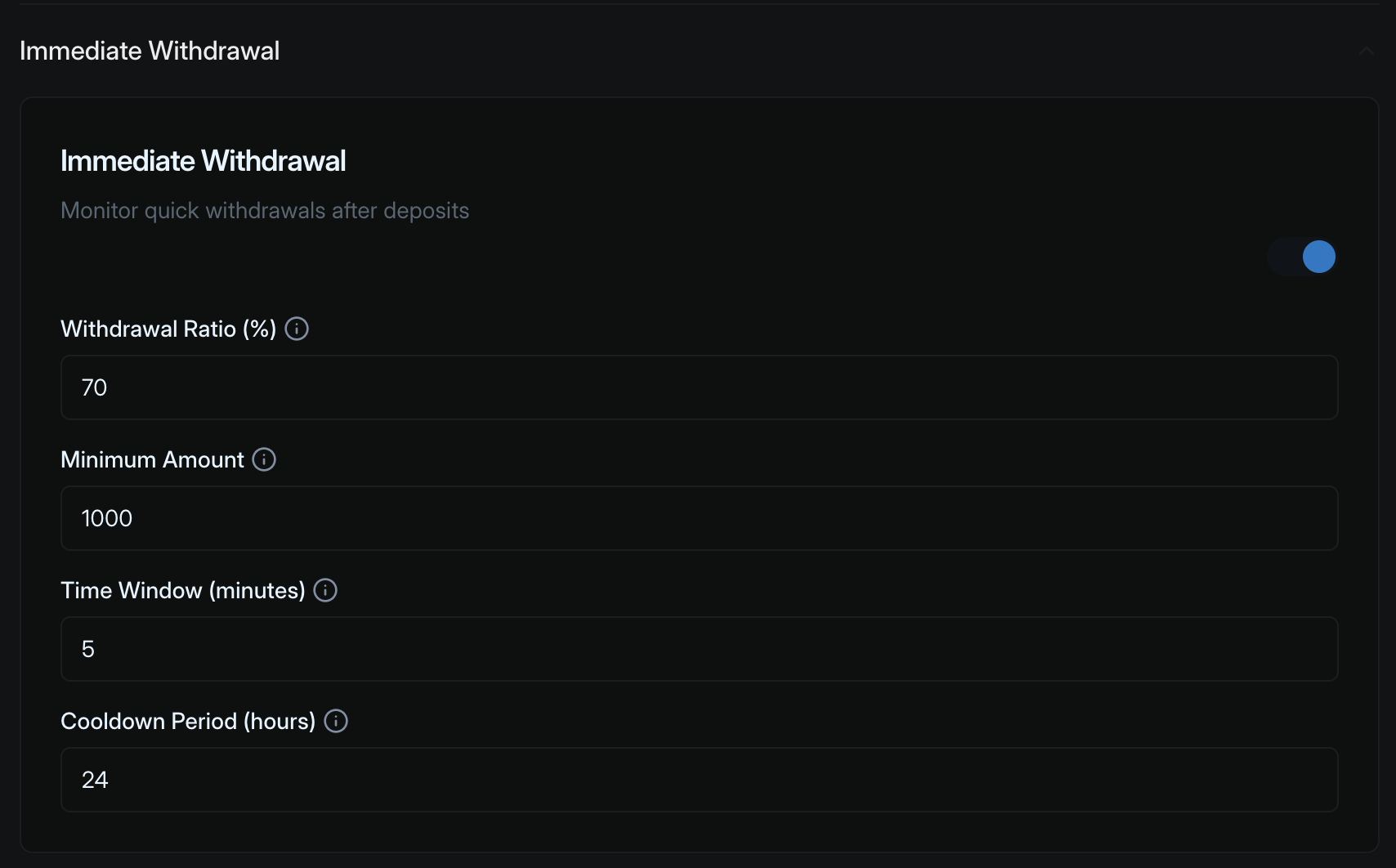

Immediate withdrawals

Withdrawal ratio (%)

Withdrawal ratio (%)

Default is set to 70%

Minimum amount

Minimum amount

Default is set to 1000

Time window (minutes)

Time window (minutes)

Default is set to 5 minutes

Cooldown period (hours)

Cooldown period (hours)

Default is set to 24

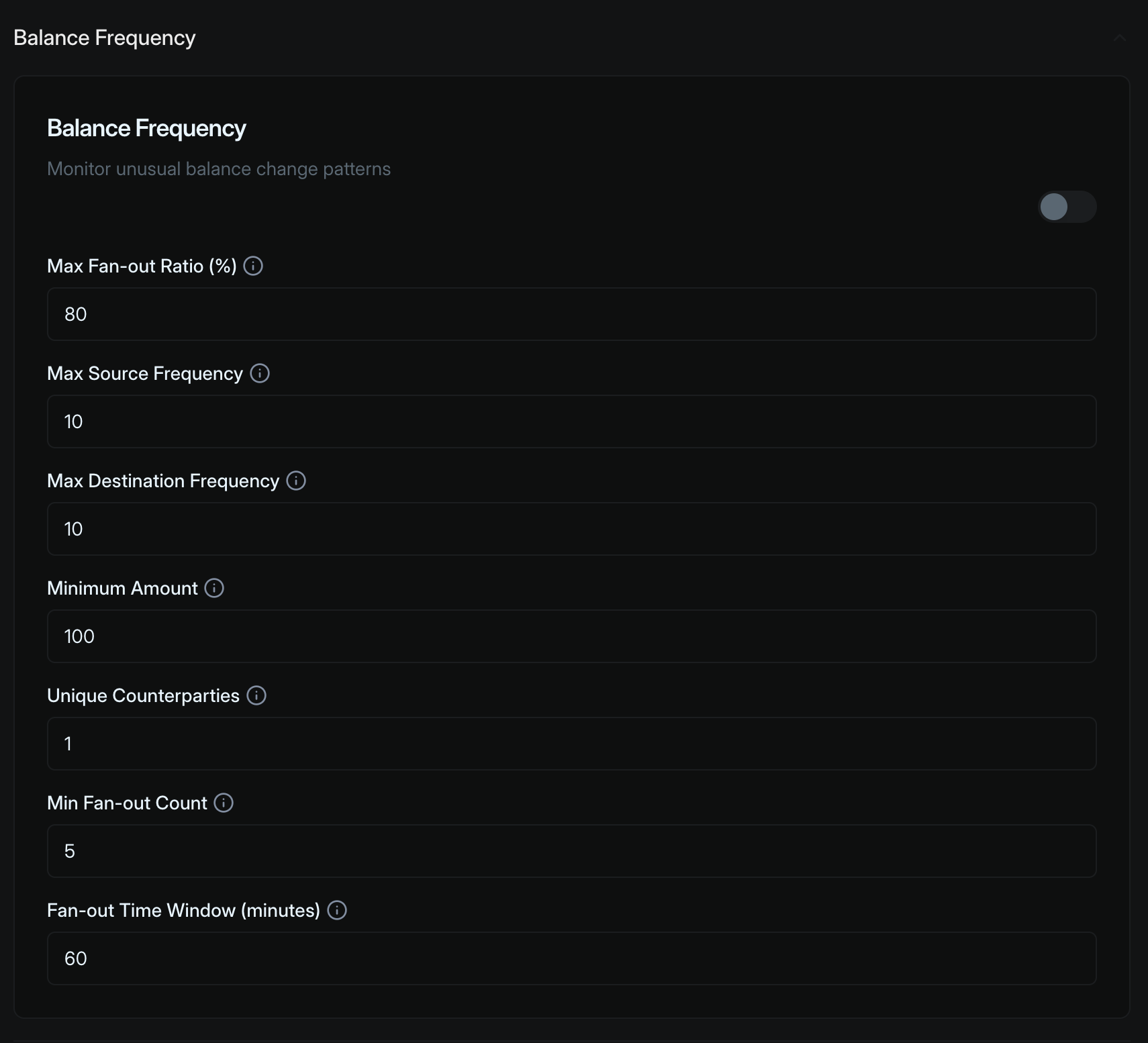

Balance frequency

Maximum fan-out ratio (%)

Maximum fan-out ratio (%)

Default is set to 80%

Maximum source frequency

Maximum source frequency

Default is set to 10

Maximum destination frequency

Maximum destination frequency

Default is set to 10

Minimum amount

Minimum amount

Default is set to 100

Unique counterparties

Unique counterparties

Default is set to 1

Minimum fan out

Minimum fan out

Default is set to 5

Fan-out time window (minutes)

Fan-out time window (minutes)

Default is set to 60 minutes

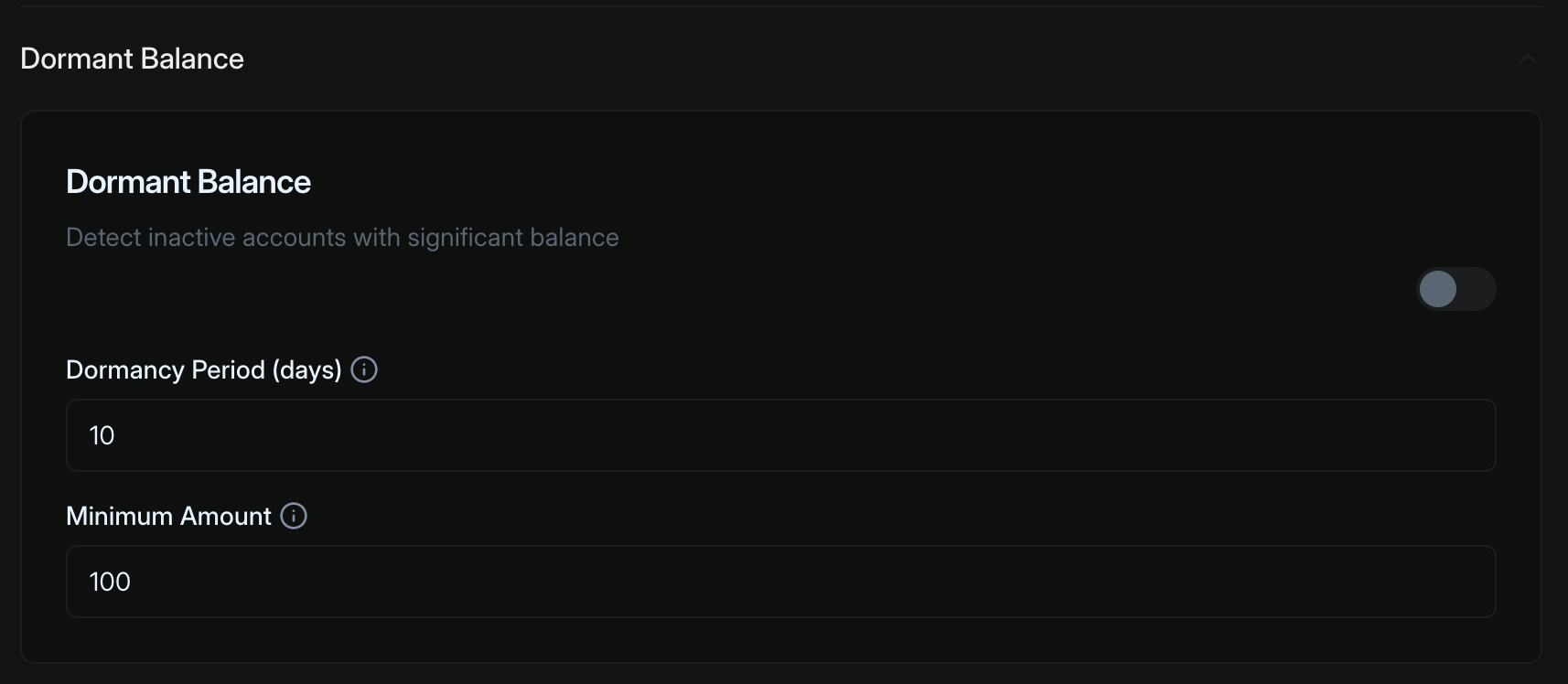

Dormant balance

Dormancy period (days)

Dormancy period (days)

Default is set to 10 days

Minimum amount

Minimum amount

Default is set to 100

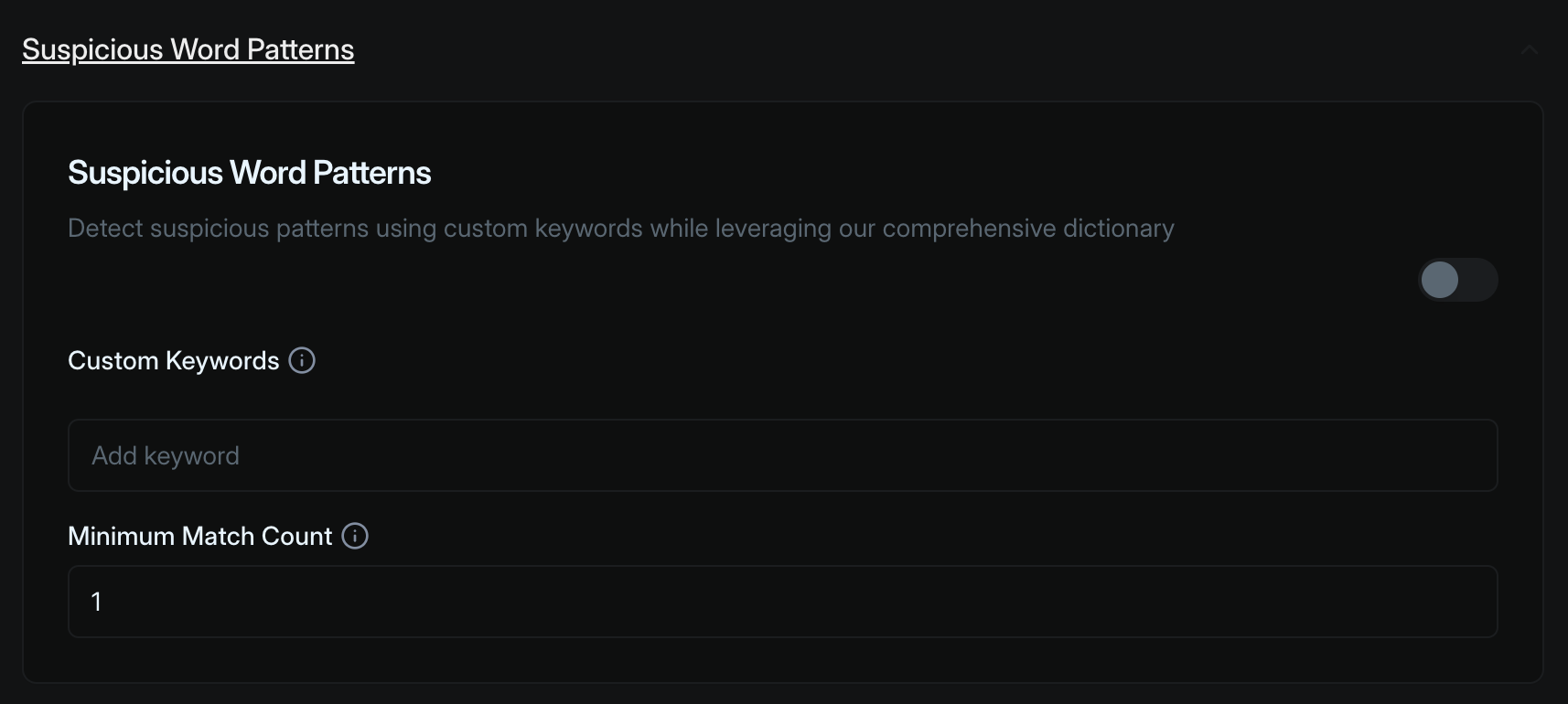

Suspicious word patterns

Custom keywords

Custom keywords

A customizable list of words or phrases that may indicate suspicious activity. You can add specific terms relevant to your business that, when detected in transaction descriptions or messages, should trigger additional scrutiny.

Minimum amount amount

Minimum amount amount

Default is set to 1

Amount deviation

Lookback period (hours)

Lookback period (hours)

This tells the system how far back to check for unusual trends. This helps establish what’s “normal” for each customer.

Minimum transactions

Minimum transactions

This defines the minimum number of transactions needed before we can determine what is unusual.

Deviation multiple

Deviation multiple

It determines how far a transaction amount can deviate from the typical pattern before being flagged as unusual. For example, if a customer typically transfers 3,000 might trigger an alert.

Minimum amount

Minimum amount

This only flags transactions above this amount. It helps to ignore small everyday transactions.

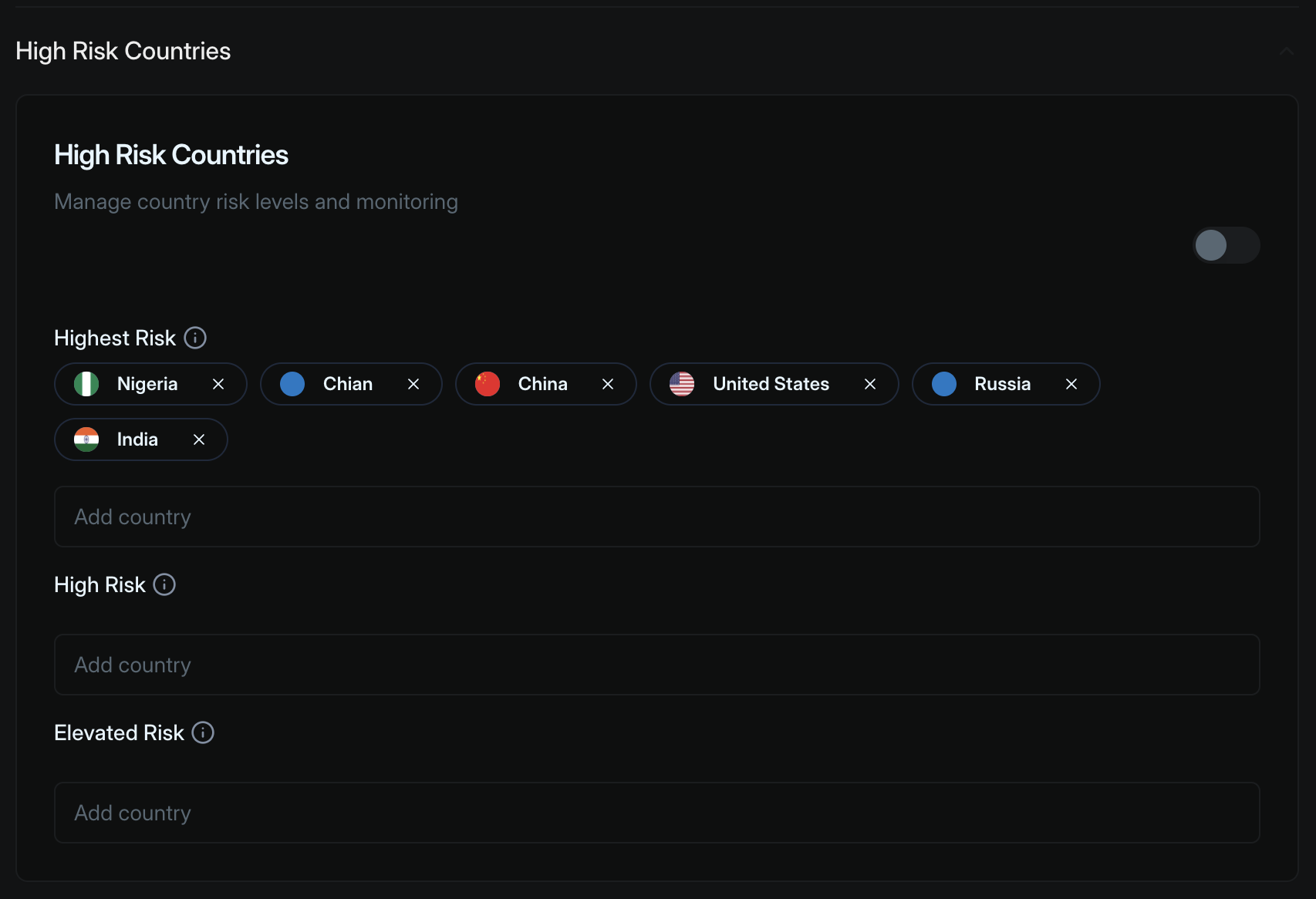

High risk countries

You can specify the state and street of a location via:

[Country]-[State]-[Street]. For example, Brazil-Rio.Highest risk

Highest risk

These countries require the most stringent monitoring and may have specific transaction restrictions. Transactions involving these countries automatically trigger an anomaly and enhanced due diligence protocols.

High risk

High risk

A secondary tier for countries that present significant but not extreme risk levels. These countries require elevated monitoring but may have less stringent controls than the highest risk category. The platform allows adding countries that warrant careful attention but don’t need the most intensive scrutiny.

Elevated risk

Elevated risk

The lowest tier of the risk-based system, used for countries that require monitoring above standard levels but don’t present major concerns. This creates a graduated approach to risk management.

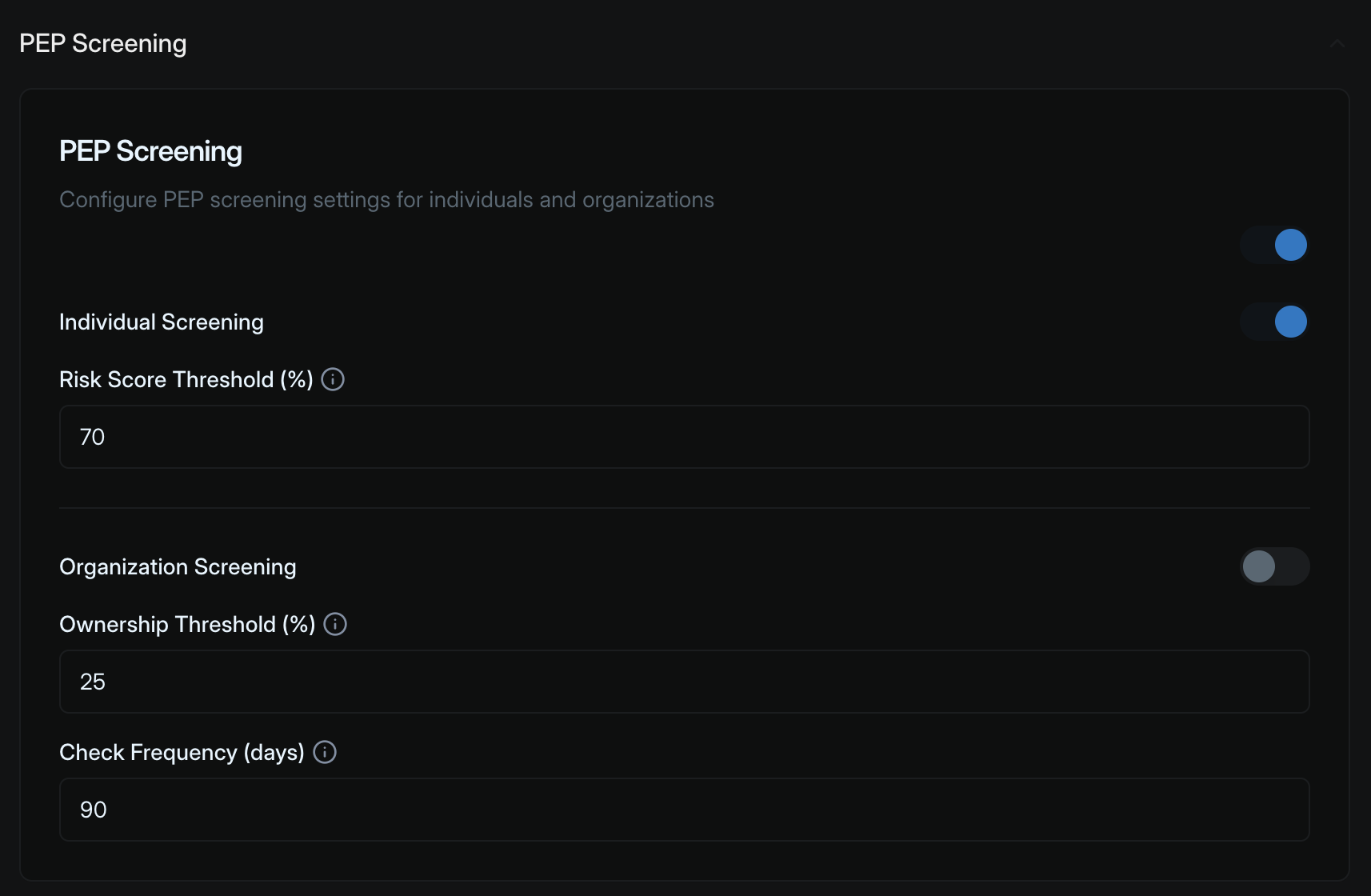

PEP screening

To enable PEP screening for your organization:- Toggle on the main PEP Screening switch at the top to activate the overall monitoring system.

- Verify that Individual Screening is enabled (blue switch).

- Enable Organization Screening by clicking its switch, ensuring you can monitor both individual PEPs and organizations where PEPs have significant control (25% ownership or more).

Risk score thresholds

Risk score thresholds

Default is set to 10 days

Ownership threshold

Ownership threshold

Default is set to 25%

Check frequency (days)

Check frequency (days)

Default is set to 90 days